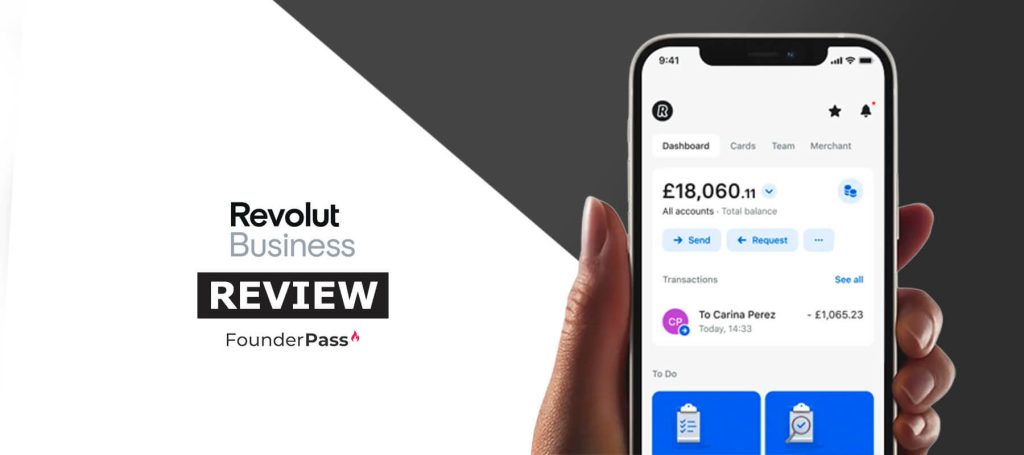

Read our in-depth Revolut Business Account review to discover if it’s worth it for your business. Learn about features, benefits, and potential drawbacks.

Managing finances can be challenging, especially for small businesses and startups. Revolut aims to simplify this with its business account. This review will provide insights into its features, usability, and whether it’s a good fit for your business needs. From seamless international transactions to expense management, Revolut promises to streamline financial operations.

But does it deliver on its promises? We will explore the key aspects of the Revolut Business Account, helping you decide if it’s the right tool for your business. Let’s dive in and see what this account has to offer.

Credit: www.youtube.com

What Is Revolut Business Account

Revolut Business Account helps businesses manage finances with ease. It offers multi-currency accounts, expense management, and seamless international payments. Ideal for startups and SMEs.

A Revolut Business Account is a digital banking solution. It caters to the financial needs of businesses. Whether you run a small startup or a large enterprise, this account offers tools to help you manage your finances better.

Key Features

The Revolut Business Account comes with various key features. One of its highlights is multi-currency accounts. You can hold and exchange 28 currencies. This helps businesses that deal internationally.

Another feature is global spending. You get corporate cards for your team. These cards allow you to control and track spending easily. It also supports integrations with popular business tools. This includes accounting software like Xero and QuickBooks.

Revolut Business also offers expense management. You can capture receipts and categorize expenses. This makes bookkeeping simpler. Automated payments are another handy feature. You can set up regular payments and never miss a bill.

How It Works

Getting started with a Revolut Business Account is straightforward. First, you sign up on their website. You will need to provide business details. This includes company name, registration number, and address.

After registration, you can start using the account. You can add money to your account via bank transfers. Once funded, you can make payments, exchange currencies, and manage expenses.

The Revolut Business mobile app is another useful tool. It allows you to manage your account on the go. You can check balances, approve payments, and track expenses right from your phone.

Overall, a Revolut Business Account simplifies business banking. It offers tools that save time and improve financial management.

“`

Benefits For Entrepreneurs

Entrepreneurs always seek ways to streamline operations and reduce costs. Revolut Business Account offers numerous benefits tailored to meet these needs. Entrepreneurs can leverage these advantages to enhance their business efficiency and save money.

Cost Savings

Revolut Business Account helps entrepreneurs save on various costs. Traditional banks often charge high fees for international transfers and currency exchanges. With Revolut, you can make international transfers at competitive rates, saving a significant amount of money. Below is a table illustrating typical savings:

| Service | Traditional Bank Fees | Revolut Fees |

|---|---|---|

| International Transfers | $30 per transfer | $0 – $5 per transfer |

| Currency Exchange | 3% markup | 0.5% markup |

Revolut also offers free and low-cost plans. Entrepreneurs can choose a plan that suits their needs and avoid unnecessary expenses. Some key features of these plans include:

- No monthly fees for the Free plan

- Low monthly fees for premium plans

- Free domestic transfers

- Free international payments up to a limit

Efficiency Boost

Revolut Business Account boosts efficiency for entrepreneurs. The platform provides a range of tools designed to simplify business operations. These tools include:

- Multi-currency accounts: Hold and manage funds in multiple currencies without extra charges.

- Automated payments: Schedule and automate payments to save time.

- Expense management: Track and manage expenses with ease.

Using Revolut’s integrated tools, entrepreneurs can streamline workflows. This allows more time to focus on core business activities. The platform also offers real-time notifications, helping keep track of all transactions instantly. Entrepreneurs can manage their finances efficiently and make informed decisions quickly.

Revolut’s user-friendly interface ensures ease of use. Entrepreneurs can navigate the platform effortlessly and access all features without hassle.

Account Types And Pricing

Revolut Business Account offers various account types and pricing plans to suit different business needs. Whether you run a small startup or a large enterprise, Revolut has a plan for you. Each plan comes with unique features and benefits tailored to different business sizes and transaction volumes. Let’s explore the account types and pricing in detail.

Free Vs Paid Plans

Revolut Business Account provides a free plan and several paid plans. The free plan is suitable for small businesses with limited transactions. It offers essential banking services without a monthly fee. Paid plans, on the other hand, come with added features and higher transaction limits. They cater to businesses with more complex needs.

The paid plans are tiered to accommodate different sizes of businesses. Each tier increases in monthly cost but also offers more advanced features. These features include higher foreign exchange allowances, priority customer support, and integrations with accounting software.

Additional Services

Revolut Business Account also offers additional services beyond the basic banking features. These services help businesses streamline their financial operations. For instance, the platform provides multi-currency accounts, which are crucial for businesses operating internationally. You can hold, exchange, and transfer money in multiple currencies at competitive rates.

Another useful service is expense management. Revolut allows you to track and manage expenses efficiently. It offers tools to automate expense reporting and categorize transactions. This feature saves time and reduces errors in financial reporting. Furthermore, businesses can issue physical and virtual cards to employees for easier expense tracking.

Revolut also provides integration with popular business tools. This includes accounting software like Xero and QuickBooks. These integrations help businesses manage their finances seamlessly. They allow automatic synchronization of transactions, reducing manual data entry. By offering these additional services, Revolut enhances business efficiency and financial management.

Credit: www.youtube.com

Setting Up Your Account

Opening a Revolut Business Account is easy. It caters to businesses of all sizes. The setup process is straightforward and quick. Let’s dive into the steps involved.

Registration Process

Begin by visiting the Revolut Business website. Click on the “Sign Up” button. You will be prompted to enter your email address and create a password. Next, provide some basic information about your business.

Fill in details like your business name, registration number, and address. You may also need to specify the type of business you operate. Once you have provided all necessary information, click “Submit.”

Verification Steps

After submitting your registration, you will need to verify your identity. Revolut will ask for proof of identity. This could be a passport or driver’s license. You may also need to upload a recent utility bill or bank statement.

Revolut will verify your documents. This usually takes a few minutes. Once verified, you can start using your Revolut Business Account. The entire setup process is designed to be user-friendly and efficient.

Using Revolut Business Account

Using a Revolut Business Account can streamline your financial operations. It offers various features designed to make business transactions easier and more efficient. Let’s dive into two key aspects: making transactions and managing finances.

Making Transactions

Revolut Business Account makes transactions simple. You can send and receive money in multiple currencies. This can save time and avoid costly currency conversion fees. The platform supports international payments. This is ideal for businesses dealing with global clients. Real-time notifications keep you updated on all transactions. This helps in monitoring and managing cash flow effectively.

Managing Finances

Managing finances with a Revolut Business Account is straightforward. The dashboard provides a clear overview of your financial status. You can track expenses, set budgets, and manage invoices. The integration with accounting software simplifies bookkeeping tasks. You can also issue virtual and physical cards for employees. This helps in controlling and monitoring business expenses. Automated reports save time and reduce errors, enhancing financial management.

Integrations And Tools

Revolut Business Account offers a range of integrations and tools. These enhance the functionality of your account. They simplify your business operations, providing seamless connections with various platforms. This helps in automating processes and improving efficiency.

Third-party Apps

Revolut Business Account integrates with many third-party apps. This enables smooth synchronization of data across different platforms. Here are some key integrations:

- Xero: Sync your transactions with ease. Keep your accounting up to date.

- QuickBooks: Connect your Revolut account for effortless bookkeeping.

- Slack: Get real-time notifications of account activities.

- Zapier: Automate repetitive tasks by connecting with over 2,000 apps.

These integrations save time and reduce manual data entry. They help you manage your business more efficiently.

Apis And Custom Solutions

Revolut provides powerful APIs for developers. This allows for the creation of custom solutions tailored to your business needs. The APIs offer various functionalities:

| API Feature | Description |

|---|---|

| Payment APIs | Process payments seamlessly from your platform. |

| Account APIs | Access real-time account data for better financial control. |

| Webhook APIs | Receive instant notifications of account activities. |

Using these APIs, you can build custom workflows. This can integrate Revolut’s services directly into your business systems. It offers flexibility and control, ensuring your operations run smoothly.

Customer Support And Resources

When choosing a business account, customer support is crucial. Revolut Business stands out in this area with various support options. From a comprehensive Help Center to active community forums, Revolut ensures you have the resources you need.

Help Center

Revolut’s Help Center is rich with information. It covers a wide range of topics. From getting started to solving common issues, you will find answers quickly. The articles are easy to read and well-organized. This makes finding information simple. It is a good first stop for help.

Community Forums

The community forums are another valuable resource. Here, Revolut users share their experiences and solutions. You can ask questions and get answers from other business owners. It is a space for support and learning. The forums are active, so you get quick responses. This peer-to-peer support is helpful and engaging.

Pros And Cons

Choosing the right business account is crucial for smooth operations. Revolut Business Account offers many features that can benefit your business. But it’s also important to know its limitations. This section outlines the pros and cons of using a Revolut Business Account.

Advantages

Revolut Business Account has several advantages. It supports multiple currencies, which is great for international businesses. You can hold, exchange, and transfer money in over 28 currencies. This reduces conversion fees and simplifies transactions.

Revolut also provides a seamless integration with accounting software. This saves time and reduces errors. Another advantage is the real-time spending notifications. You can track your expenses instantly. This helps in better financial management.

The account offers flexible payment options. You can pay suppliers and employees with ease. The app is user-friendly and intuitive. This makes managing finances simple and quick.

Limitations

Despite its benefits, there are some limitations. Customer support can be slow at times. This may cause delays in resolving issues.

Revolut Business Account has limited cash handling options. Businesses that deal with cash may find this inconvenient. Another drawback is the fee structure. Some services come with hidden charges.

The account may not suit large enterprises. It is more tailored to small and medium-sized businesses. Additionally, some features are restricted based on your location. This can limit your business operations.

Frequently Asked Questions

What Is A Revolut Business Account?

A Revolut Business Account is a financial service designed for businesses. It offers various features like multi-currency accounts, international payments, and expense management. It’s ideal for companies operating globally.

How To Open A Revolut Business Account?

To open a Revolut Business Account, visit the Revolut website. Complete the online registration form. Provide necessary business documents. Once verified, your account will be activated.

Are There Fees For A Revolut Business Account?

Yes, Revolut Business Account has different pricing plans. It offers free and paid plans. Fees vary based on the selected plan and features used.

What Features Does Revolut Business Account Offer?

Revolut Business Account offers multi-currency accounts, international transfers, corporate cards, and expense management. It also provides integration with accounting software and real-time transaction tracking.

Conclusion

Revolut Business Account offers many benefits for small and medium businesses. It provides easy access to financial tools, making daily operations smooth. Transparent fees ensure no hidden costs. Customer support is responsive and helpful. The account is suitable for businesses seeking efficient and reliable banking solutions.

Its features cater to various needs, simplifying financial management. Consider Revolut Business for a straightforward banking experience. It can help streamline your business finances effectively.