Learn how to add Stripe payments as customers in QuickBooks Online with our simple guide. Boost your accounting efficiency today!

Managing your finances can be challenging, especially when handling multiple payment platforms. QuickBooks Online and Stripe are two powerful tools that can simplify this process. Integrating Stripe payments with QuickBooks allows for seamless tracking of transactions and customer data. This ensures accurate financial records and saves valuable time.

In this guide, we will walk you through the steps to add Stripe payments as customers in QuickBooks Online. This will help you keep your financials organized and up-to-date. Ready to streamline your accounting? Let’s get started!

Credit: www.pabbly.com

Introduction To Stripe And Quickbooks Online

Managing payments and accounting can be time-consuming. Stripe and QuickBooks Online simplify this process. Stripe is a popular payment processor. QuickBooks Online is a well-known accounting software. Integrating these tools can save time and reduce errors.

Benefits Of Integration

There are many benefits to integrating Stripe with QuickBooks Online. First, it automates payment entries. This reduces the chance of manual errors. Second, it saves time. You do not need to enter data twice. Third, it provides real-time updates. You can see your financial status quickly. Fourth, it improves accuracy. The integration ensures data consistency. Finally, it enhances financial reporting. You can generate detailed reports easily.

Overview Of The Process

Setting up the integration is straightforward. First, sign in to QuickBooks Online. Then, go to the Apps section. Search for the Stripe integration app. Click “Get App Now” and follow the prompts. Authorize the connection between Stripe and QuickBooks Online. After connecting, map your Stripe transactions to the correct accounts in QuickBooks. This step ensures accurate reporting. Finally, verify the integration is working correctly. Review a few transactions to confirm.

Credit: www.chargebee.com

Setting Up Stripe Account

Adding Stripe payments to QuickBooks Online is simple. First, set up your Stripe account. Then, integrate Stripe with QuickBooks to track customer payments easily.

To start accepting payments through Stripe in QuickBooks Online, you need to set up your Stripe account first. This involves creating an account and configuring the payment settings. Here’s a step-by-step guide to help you through the process.

Creating A Stripe Account

First, visit the Stripe website. Click on the “Sign Up” button. Enter your email address, full name, and create a password. Then, click “Create your Stripe account.”

Next, you’ll need to verify your email. Check your inbox and click the verification link sent by Stripe. This will activate your account.

After verifying your email, log in to your new Stripe account. You will be prompted to enter additional details. This includes your business information, bank account details, and personal identification.

Make sure all the information is accurate. This will help avoid any issues later on. Once completed, your Stripe account is ready to use.

Configuring Payment Settings

Log in to your Stripe dashboard. Navigate to the “Settings” option on the left menu. Under “Business Settings,” select “Payments.”

Here, you can set up your payment methods. Choose the options that suit your business needs. Stripe offers various methods like credit cards, ACH transfers, and digital wallets.

Next, enable the currencies you wish to accept. This is crucial if you have international customers. Click “Save” after making your selections.

Now, go to the “Payouts” section. Set your payout schedule according to your preference. You can choose daily, weekly, or monthly payouts.

Lastly, review your settings to ensure everything is correct. This helps in smooth payment processing. Your Stripe account is now configured and ready to integrate with QuickBooks Online.

“`

Preparing Quickbooks Online

Ready to add Stripe payments in QuickBooks Online? First, prepare your QuickBooks Online account. This will ensure smooth integration. Follow these steps to get started.

Account Setup

Proper account setup is crucial. Here are the steps:

- Log in to your QuickBooks Online account.

- Go to the Settings gear icon.

- Select Chart of Accounts.

- Click New to create a new account.

- Choose Bank as the account type.

- Name the account Stripe Payments.

- Save the new account.

Follow these steps to ensure your account is set up correctly. Proper setup will make connecting apps easier.

Connecting Apps

Next, connect your apps. This allows QuickBooks Online to sync with Stripe.

- Go to the Apps section in QuickBooks Online.

- Search for Stripe in the search bar.

- Select the Stripe app from the results.

- Click Get App Now.

- Follow the prompts to authorize the connection.

- Enter your Stripe credentials when prompted.

- Complete the connection process.

Connecting apps enables data transfer between QuickBooks Online and Stripe. This ensures seamless payment tracking.

Integrating Stripe With Quickbooks Online

Integrating Stripe with QuickBooks Online can simplify your business operations. This integration helps you to track payments efficiently and manage your finances with ease. There are two main methods to achieve this integration: using third-party apps or following manual integration steps. Let’s explore both methods.

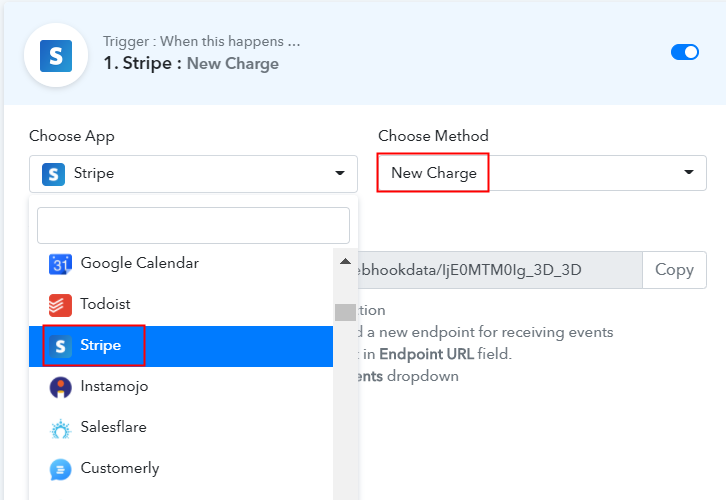

Using Third-party Apps

Third-party apps can streamline the integration of Stripe with QuickBooks Online. These apps offer automated solutions, reducing manual work.

Here are some popular third-party apps:

- Zapier: Connects Stripe and QuickBooks Online seamlessly.

- Sync with Stripe: Directly integrates payments into QuickBooks.

- OneSaas: Synchronizes data between Stripe and QuickBooks.

These apps provide user-friendly interfaces and step-by-step guides. They ensure data accuracy and save time.

Manual Integration Steps

Manual integration requires more effort but offers greater control. Follow these steps to manually integrate Stripe with QuickBooks Online:

- Log in to your Stripe account.

- Navigate to the Payments section.

- Export your payment data as a CSV file.

- Log in to your QuickBooks Online account.

- Go to the Banking or Transactions tab.

- Click on Upload transactions manually.

- Choose the CSV file you exported from Stripe.

- Map the fields to match QuickBooks Online’s format.

- Review the imported data and click Save.

Manual integration ensures you have control over each transaction. It’s a good option for businesses with fewer transactions or those needing custom setups.

Recording Payments In Quickbooks Online

Recording payments in QuickBooks Online helps keep your accounts accurate. For those using Stripe, it is essential to know how to add these payments properly. This ensures your financial records are up-to-date and error-free.

Creating Customer Records

First, open QuickBooks Online and go to the “Sales” menu. Click on “Customers” and select “New Customer.” Enter the customer’s details, like name, email, and address. Save the information by clicking “Save.” This step is crucial before you can record any payments.

Entering Payment Details

After creating the customer record, navigate to the “Sales” menu. Click on “Receive Payment” to start. Choose the customer you just added from the drop-down list. Enter the payment amount and select “Stripe” as the payment method. Ensure the date and other details match your Stripe transaction. Click “Save and close” to record the payment.

Automating Payment Entries

Automating payment entries in QuickBooks Online can save time and reduce errors. For businesses using Stripe, automating the process ensures that every transaction is accurately recorded. This enhances financial accuracy and simplifies bookkeeping tasks.

Using Sync Tools

Sync tools help connect Stripe with QuickBooks Online. These tools transfer payment data automatically. This eliminates the need for manual entry. Popular options include Zapier and QuickBooks Sync by PayTraQer. Choose a tool that fits your business needs. Follow the setup instructions to link your Stripe account with QuickBooks Online.

Once linked, the sync tool will start transferring data. Stripe transactions will appear in QuickBooks Online. This ensures that all payments are recorded correctly. Sync tools can handle large volumes of data. This makes them ideal for businesses with many transactions.

Setting Up Automation Rules

Automation rules help customize how data is transferred. This ensures that every transaction is categorized correctly. In QuickBooks Online, navigate to the settings menu. Look for the automation options. Create rules based on your business needs.

For example, categorize Stripe payments as sales income. Or assign specific expenses to certain categories. Set these rules once, and they will apply automatically. This reduces the chance of errors. It also ensures consistency in your financial records.

Review your automation rules regularly. This ensures they continue to meet your business needs. Adjust them as your business evolves. This keeps your financial records accurate and up-to-date.

Troubleshooting Common Issues

Adding Stripe payments to QuickBooks Online can sometimes be challenging. Issues can arise that disrupt the smooth integration. Knowing how to troubleshoot these problems is crucial for maintaining accurate records. Let’s explore some common issues and their solutions.

Sync Errors

Sync errors can occur during the integration of Stripe with QuickBooks Online. These errors may stop the flow of data between the two platforms. Check if both Stripe and QuickBooks Online are connected properly. Verify that your credentials are correct.

Another common issue is outdated software. Ensure that both platforms are updated to the latest versions. Sometimes, the sync settings may not be configured correctly. Review the settings and make necessary adjustments.

Discrepancies In Records

Discrepancies in records are another frequent issue. These can happen when transactions are not correctly recorded in QuickBooks. Start by comparing the Stripe transactions with those in QuickBooks Online. Look for missing or duplicate entries.

Ensure that the currency settings match in both platforms. Sometimes, discrepancies can occur due to different time zones. Adjust the time zone settings to ensure they are consistent. Regular reconciliation can help identify and correct these issues.

Best Practices For Managing Payments

Managing payments effectively in QuickBooks Online ensures smooth financial operations. Proper management of Stripe payments as customers in QuickBooks Online can streamline your bookkeeping processes. Here are some best practices to follow:

Regular Reconciliation

Reconcile your Stripe transactions with QuickBooks Online on a regular basis. This helps to ensure that all transactions are accurately recorded. Regular reconciliation helps to identify any discrepancies early. Follow these steps to reconcile:

- Go to the Banking tab in QuickBooks Online.

- Choose your Stripe account.

- Match each Stripe transaction with the corresponding QuickBooks entry.

Regular reconciliation keeps your financial records up-to-date. This practice helps you maintain accurate financial statements.

Maintaining Accurate Records

Maintaining accurate records is crucial for financial management. Ensure all Stripe payments are correctly recorded in QuickBooks Online. This practice avoids errors and ensures data integrity. Use the following tips to maintain accurate records:

- Regularly update payment information.

- Use clear and concise descriptions for each transaction.

- Keep digital copies of all receipts and invoices.

Accurate records simplify tax preparation and financial analysis. This ensures compliance with financial regulations.

Additional Resources

Adding Stripe payments as customers in QuickBooks Online can be a bit complex. But don’t worry. There are many resources available to help you. These resources can guide you through the process and solve common issues. You can find tutorials, support communities, and other helpful materials. Let’s explore these additional resources to make your integration smoother.

Helpful Tutorials

Many websites offer step-by-step tutorials. These can be a great help. YouTube has many video guides. You can watch them at your own pace. QuickBooks’ official website also has detailed articles. These articles cover each step in detail.

Don’t forget about blogs. Many finance and accounting blogs write about integrating Stripe with QuickBooks. These tutorials often include screenshots. This visual aid can make the process easier to understand.

Support And Community

QuickBooks has a dedicated support team. They can answer your specific questions. You can contact them via phone or chat. Stripe also offers customer support. Their team is ready to help with any issues you face.

Online communities are also valuable. Forums like QuickBooks Community and Reddit have many users. These users share their experiences and solutions. You can post your questions and get answers from real users. This peer support can be very helpful.

Credit: www.youtube.com

Frequently Asked Questions

How Do I Link Stripe To Quickbooks Online?

To link Stripe to QuickBooks Online, use a third-party integration tool. These tools automate the data transfer between Stripe and QuickBooks, making the process seamless and efficient.

Can I Import Stripe Transactions Into Quickbooks Online?

Yes, you can import Stripe transactions into QuickBooks Online. Use the integration tool to automate this process, ensuring accurate financial records.

Are Stripe Fees Automatically Recorded In Quickbooks?

Stripe fees can be automatically recorded in QuickBooks with the right integration. This helps maintain accurate financial data and simplifies accounting tasks.

How Often Should I Sync Stripe With Quickbooks?

Syncing Stripe with QuickBooks should be done regularly. Daily syncing is recommended to keep your financial records up-to-date and accurate.

Conclusion

Adding Stripe payments to QuickBooks Online is straightforward. First, connect your accounts. Then, sync your transactions seamlessly. This setup saves time and reduces errors. It also provides a clear financial picture. Follow these steps to streamline your accounting process. With these tools, managing your business finances becomes easier.

Your focus can remain on growth and customer satisfaction. Keep your accounting simple. Boost your efficiency. Stay organized with Stripe and QuickBooks Online.